Why choose Armstrong Lawyers to prepare your Will?

Each client engagement is personally handled by our experienced lawyers who aim to provide fast and effective handling of your legal matter.

The benefit of choosing Armstrong Lawyers to prepare your Will is that we ensure that:

- your Will operates in the manner that you intend;

- the likelihood of a person challenging your Will is minimised; and

- you receive appropriate advice and take into consideration the matters that are relevant and important to deal with when considering your estate and future care and welfare of your family.

Family Issues and Wills

Armstrong Lawyers can advise you about appropriate strategies when drafting your Will to deal with family issues including:

-

second marriages;

-

blended families;

-

difficult in-laws; and

-

family members who have financial difficulties, or physical or psychological disabilities.

Engaging Armstrong Lawyers to prepare your Will

If you would like to engage Armstrong Lawyers to prepare your Will:

- Please telephone or email us to make an appointment so that we may receive your instructions;

- We generally request that you provide us with detailed written information before we meet;

- We then meet with you in conference to receive your instructions and provide you advice;

- We then draft your Will and then discuss the draft Will with you; and

- Finally, we then arrange to meet with you to sign the Will.

We provide a safe storage facility at no fee.

Drafting Wills

Why do you need a Will?

Without a Will, you have no control over who will benefit from your estate. When a person dies without a valid Will, they die ‘intestate’ and the estate will be distributed according to the provisions of the Administration and Probate Act 1958 (Vic). On the other hand, a well drafted Will should provide an effective defence against claims and ensure that your assets are distributed according to your wishes when you pass away.

What are the requirements for a valid Will?

For a Will to be valid, the person making the will (the testator) must generally:

- Have capacity:

- Age – generally over 18;

- Soundness of mind, memory and understanding of:

- The nature and effects of the act; and

- The extent of the property being disposed;

- Have intention to make an act of testation;

- Have knowledge and approval of the contents of the Will; and

- Follow the proper formalities, including having the Will in writing and signed by the testator and 2 witnesses.

What about informal Wills and documents?

In Victoria, the court has the power to admit to probate an informal (and even unsigned) document if the deceased intended the document to be her or his Will.

Can I challenge a Will?

There are situations when a person may challenge a Will. To find out more about Challenging a Will, click here.

Powers of Attorney

Customarily we advise clients who are preparing a Will to also consider grant a power of attorney. The Will operates in the event of your death; the power of attorney gives another person the legal right to act on your behalf while you are alive.

Customarily we advise clients who are preparing a Will to also consider grant a power of attorney. The Will operates in the event of your death; the power of attorney gives another person the legal right to act on your behalf while you are alive.

Armstrong Lawyers is able to prepare a power of attorney for you, and

-

advise you how the power operates; and

-

ensure you take into consideration the matters that are relevant and important.

What is a power of attorney?

A power of attorney is a legal document authorising a person (the attorney) to act on your behalf. This allows someone you trust to manage your affairs when you are no longer able to do so.

What are the requirements to give someone power of attorney?

You must be over 18 and understand:

-

The nature of the document you are signing;

-

What powers are being granted;

-

What powers are being retained; and

-

The options to cancel or change the attorney.

The appointed attorney must:

-

Be over 18;

-

Agree to be the attorney;

-

Have legal capacity; and

-

Be someone trusted to look after the welfare of the person giving power.

What are the common types of powers of attorney?

- Enduring power of attorney (financial) to make financial and legal decisions on your behalf.

-

Enduring power of attorney (medical) to make decisions about medical treatment on your behalf if you become incompetent as a result of ageing, mental or physical illness or injury. This does not empower the attorney to arrange euthanasia or refuse sedatives.

-

Enduring power of guardianship to make personal, lifestyle and medical treatment decisions in the event of your incapacity. This does not empower consenting to or refusing any medical treatment.

-

General power of attorney to act on your behalf in limited circumstances.

Estate Planning

Armstrong Lawyers Estate Planning Advice

A Will generally deals with the personal and real property you own as at the date of your death. There are matters, other than the preparation of a Will that may need to be considered which may include in respect of companies, trusts, superannuation funds and jointly held property. Armstrong Lawyers can provide you appropriate advice in respect of these matters.

A Will generally deals with the personal and real property you own as at the date of your death. There are matters, other than the preparation of a Will that may need to be considered which may include in respect of companies, trusts, superannuation funds and jointly held property. Armstrong Lawyers can provide you appropriate advice in respect of these matters.

Testamentary Trusts

A Testamentary Trust is a device that allows for certain trust arrangements to be made for a gift in a Will. The terms of the trust are governed by the Will and come into existence upon the death of the testator or testatrix (the Will-maker) to place the trustee in charge of the distribution of the gift to the beneficiary.

What are the advantages of Testamentary Trusts?

Testamentary Trusts provide a number of benefits including:

-

The ability to organise more complex arrangements and control the distribution of property;

-

The protection of the trust property from creditors of the beneficiary, and third parties such as parents or step-parents, or the beneficiaries themselves since there is a separation of legal ownership from the beneficiaries; and

-

Obtaining tax benefits in certain circumstances where inherited money could be distributed to those with the lowest income and marginal tax rates, such as a minor who could take advantage of the income tax free threshold.

Issues in respect of Testamentary Trusts may be complex and receving proper advice is essential.

Case Study

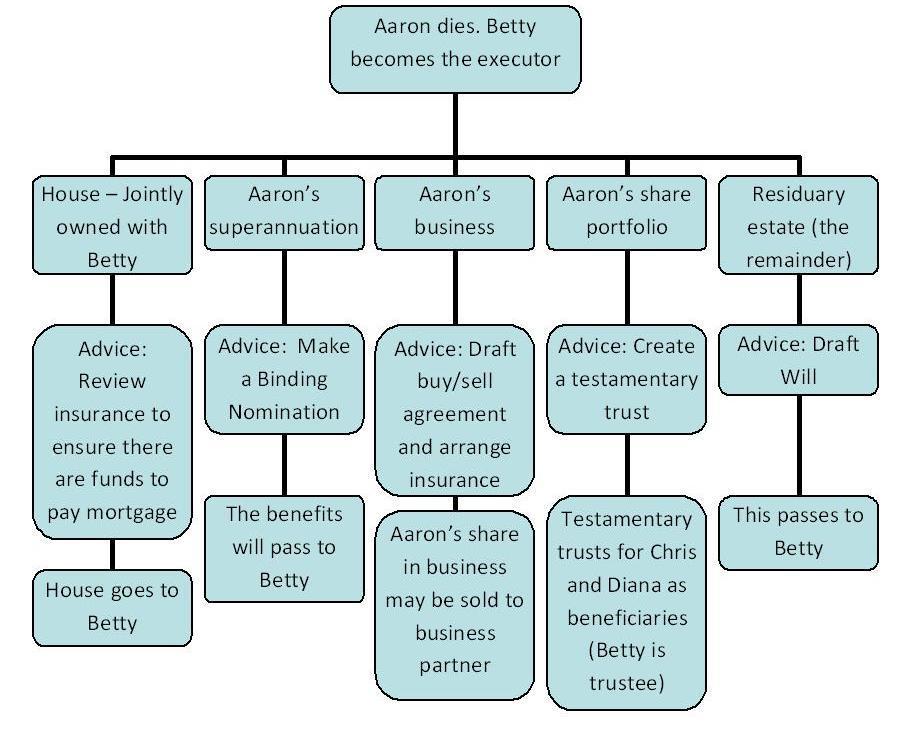

Aaron and Betty, a married couple, want to protect their estate in the event that Aaron dies, and provide for their 2 children, Chris (12 years old) and Diana (14 years old). The following are in Aaron’s name: a house; Aaron’s superannuation; share of a business; portfolio of shares; and cash in a bank account.

Upon discussion with Armstrong Lawyers, Aaron and Betty come up with the following estate plan if Aaron dies:

Free initial advice

For obligation free, no cost initial legal advice:

– call us on 134 134; or

– email us at office@armstronglawyers.com.au

FAQs

Click here to find answers to frequently asked questions in respect of Drafting Wills & Powers of Attorney.